If you’re thinking about buying a foreclosure house, think again. I’ve written elsewhere that the foreclosure market is in chaos. It really is. The loss mitigation departments of the national banks and the short sale divisions of the national banks are at a loss for leadership and management that understands fundamentally how to handle their work load.

Buying a home that is a foreclosure or a short sale, at least from a national bank, can end up being a nightmare or a dead end in terms of trying to get a reasonable transaction put together with a real closing date in the not-too-distant future.

I had a short sale offer on one of my listings that the Bank of America should have accepted in a heartbeat, but they could not get their bureaucratic act together. The kind lady working at their short sale division told me she could not even get the offer considered, although she knew it was an offer that should be accepted immediately. Another bank killed an offer by a client of mine over $5,000. It was a reasonable offer, too. Can you imagine any seller killing a sale over $5,000? That bank still has that house sitting on the market months later.

But here’s what I want to share with you today, and this is an exclusive. I recently wrote an offer for a buyer on a foreclosure, and we did reach an agreement on the price and all the terms. But then the REO, the entity that represents the bank that foreclosed, presented my clients with a mandatory Addendum that literally made my clients walk away from an otherwise great transaction.

What kind of Addendum would scare buyers away? An eight page Addendum that added numerous ridiculous terms that were totally uncalled for, absolutely offensive, but more than that some of these terms changed their basic agreement and would have made financing mathematically impossible. They demanded the loan have final approval within 21 days of mutual acceptance. That’s impossible. Thirty days is standard.

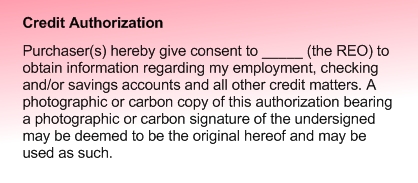

But here’s the clause that might just get your blood perking. Imagine the seller of a home demanding full access to your personal checking and savings accounts and all your personal credit information. I’m talking about the seller, not your lender. Your lender is entitled to that information–confidentially. But can you imagine the seller demanding unlimited access to your personal financial world? This REO, representing the selling bank, demanded just that. There is no reason on earth for the REO to need that information. None whatsoever. Here’s the clause from that ridiculous and poorly drafted Addendum:

Would you ever agree to give a seller that information? This is an REO who can give this information to their staff, wherever and whoever they may be, to their other contractors (and there are several), and to the bank they represent. In other words, your personal financial information could get broadcasted to many unknown people and organizations out there. Unbelievable. In this day of identity theft, who in the world would agree to such outlandish demands?

Would you ever agree to give a seller that information? This is an REO who can give this information to their staff, wherever and whoever they may be, to their other contractors (and there are several), and to the bank they represent. In other words, your personal financial information could get broadcasted to many unknown people and organizations out there. Unbelievable. In this day of identity theft, who in the world would agree to such outlandish demands?

By the way, this Addendum is only provided after you have made an offer, gone back and forth with counteroffers and gotten the REO to agree. Then they thrust this Addendum on you without any previous warning of the outlandish terms. Also, as part of their game, they refuse to sign or initial a Washington State Purchase and Sale Agreement in their counters. Instead, they make their “counteroffers” in an informal email with their listing agent. They refuse to make any commitments at all until they spring their Addendum on you, and by then you’ve spent many days or a couple of weeks going back and forth on what you thought were counteroffers so you could actually arrive at mutual acceptance.

Imagine having spent many days, or more than likely a couple of weeks looking at homes, narrowing down the many homes you have looked at, meeting with a loan officer to get pre-qualified, and then making an offer and working through all the conversations and issues on the counteroffers back and forth, only to have the rug pulled out from under you at the 11th hour when you thought you had a deal? You feel you are back to square one, and your emotional reserves may be drained at that point. You may even be so discouraged, you don’t feel like starting all over again to find another house. Welcome to the foreclosure market!

This is just the tip of the iceberg and only a little example of how chaotic the foreclosure market is. Want to see the whole Addendum from an REO, all eight pages? Much of this agreement is boilerplate, which is totally unnecessary since it is in the Washington contract we all use already, but if you read through this in detail, you’ll see many clauses that were clearly not written by an attorney and which are totally unacceptable and unreasonable to any intelligent buyer.

(The names of the parties have been deleted to protect myself from frivolous lawsuits.)

Why did I scan this agreement and make it available to you? Because I believe consumers deserve the truth and what banks and REO’s are doing to consumers behind the scenes is full of legal and ethical problems that could cause serious harm to home buyers. My mission as a buyer’s agent is to work hard for my buyers and to protect them from this kind of nonsense.

Last Updated on September 22, 2009 by Chuck Marunde

Thank you for writing that great post, very informative and educational.

I’m currently considering getting property in the us but by the looks of it this will need a lot more consideration. I don’t know about this “Addendum” business, and I’m not sure why the seller needs to know credit and savings info.

thanks for this truly eye opening article on some of the “hidden” aspects of buying at foreclosures.

Hey there,

Doing some research on purchasing REOs and came across your blog post. Just a quick FYI for your readers, the reason why the banks want the bank account info is because the bank/lender needs to comply with certain provision of The Patriot Act. All REOs with banks as sellers are going to ask the buyers to furnish this info.

Indeed the banks are also required to have safeguards around that private information in order to keep it secure. THat’s a different federal law. 🙂

Thanks Jillayne. Your are quite right. Chuck